Before investing in meme stocks

Photo by Clay Banks - Unsplash

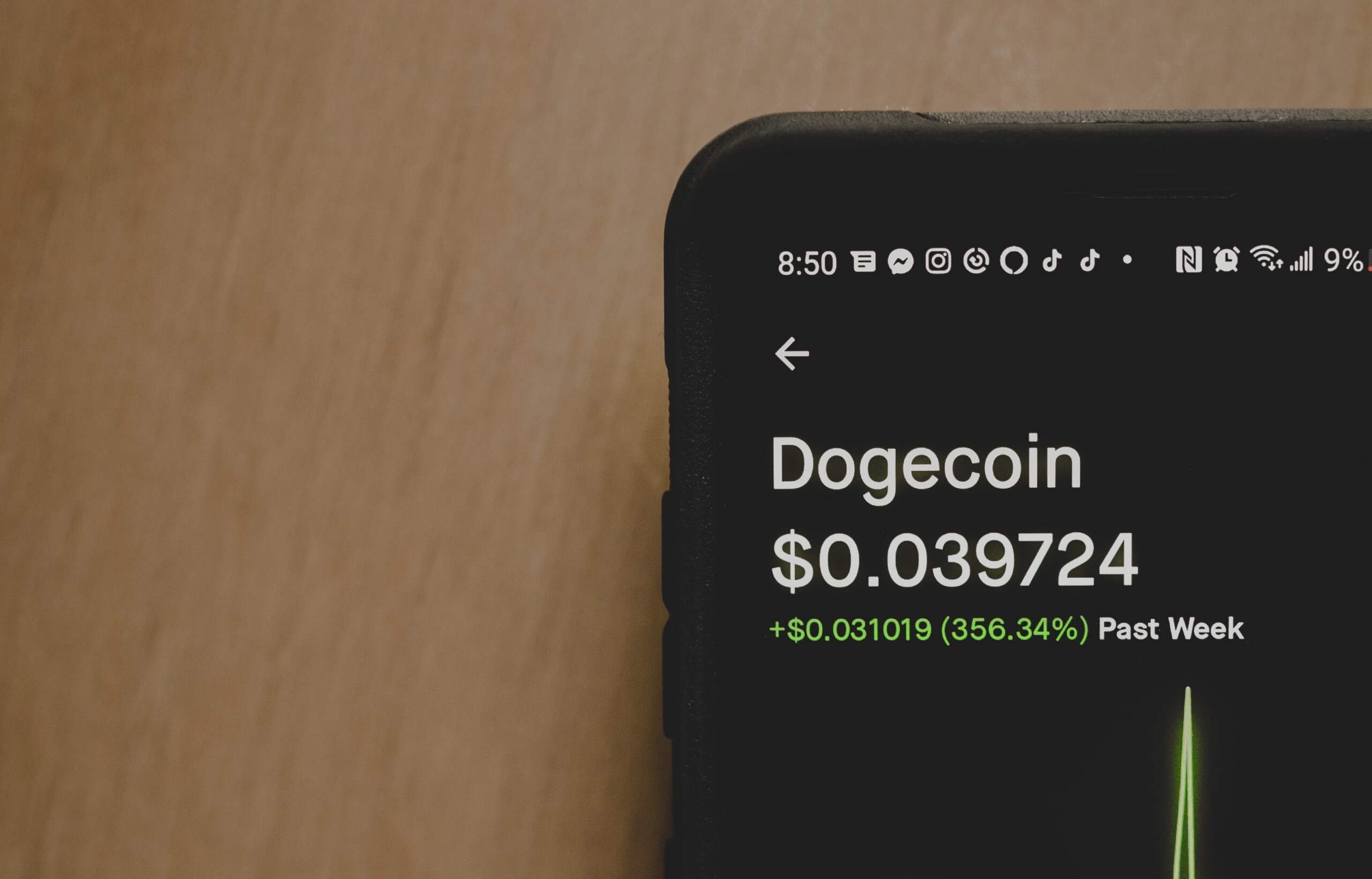

You may have heard or read about a series of select companies discussed heavily on social media and Reddit, surging in value seemingly overnight. Referenced as “meme stocks” in the news and online, these companies are a select but growing assortment whose significant growth in price is fueled by the excitement and hype generated on social media and online forums like Reddit, and may not always accurately reflect underlying fundamentals. While the idea of buying into these companies with the expectation of huge returns may sound enticing, there are a few things you should consider before investing your money.

FOMO can lead you to risk far more than you’re comfortable with

FOMO, or The Fear of Missing Out, is one of the most challenging obstacles investors can face, especially when investment opportunities are championed on social media by seemingly everybody. While some investors have made money from meme stocks, many others lost substantial amounts due to the volatile spikes and dips in their values. As concluded in the Stanford Encylopedia of Philosophy, people have a strong tendency to want to avoid losses, and when it comes to investing, that can mean both wanting to get in on the next “big thing” or holding on to a stock that is losing significant value with the hopes that it will change. Before investing in any stock online, contemplate if you’re able to stomach a high level of risk and the possibility you may lose most or all of your money.

Investing in social hype instead of fundamentals can expose you to fraud

Investing in stocks can be a powerful tool to grow your wealth but requires you to do considerable research into the company, the products and services it offers, the experience of its leadership and the industry landscape it competes in. Doing your due diligence enables you to assess whether the company is legitimate, has the potential to grow in value and whether the investment is suitable for you and your risk tolerance.

Online forums for investors to meet up and discuss investment opportunities have led to a blend of both speculation, hype and in some cases, inaccurate analysis. Online forums and social media can also quickly become an echo chamber of a particular positive sentiment towards a stock with little or no fundamental business reasoning. This can result in wild swings of the stock’s price that make it virtually impossible to make sense of the stock’s real value as it no longer corresponds to the company’s performance. While not all investment opportunities hyped up on social media are fraudulent, scam artists also use this avenue to promote fraudulent investment scams to excited investors.

When it comes to your investing strategy, never let social media channels be your sole source for investing information and research. Before investing in any company, research its fundamentals and legitimacy to avoid the heartache of an unsuitable or, worse yet, fraudulent investment.

Investing in meme stock can derail your investment objectives and financial plan

Developing a financial plan and objectives for your investments is an important first step for any investor. By considering your age, life goals, time horizon, and level of risk tolerance, you can develop a meaningful plan of action that may combine various securities like exchange-traded funds, mutual funds, and stocks to meet your goals. While helping you achieve your goals, a financial plan also helps you evaluate any new investment opportunity against those goals.

Meme stocks are a relatively new phenomenon that can quickly derail your financial plans if you let them. The hype of massive returns echoed by other investors online can blind you to the age-old fact that high returns in the investment world come with higher risk. The speculative nature of these investments and the hype that social media brings to them does not guarantee wealth. If you plan to incorporate meme stocks into your financial plan, seriously consider if you can absorb a loss of some or all of your investment.

The foundation for long-term investing success relies on the core concepts of diversifying your investments, maximizing the power of compounding interest and always sticking to the right level of risk for you. With the rising popularity of meme stocks, it may sound like an appealing way to start investing or a relevant strategy to integrate into your financial plan, but it could end up doing far more harm to you than good.