Avoiding fraud in the digital age

Photo by Clay Banks

Many feel immune to fraud, even after hearing the experiences of those online and in our lives. The reality is that the number one crime experienced by older adults is fraud.

Canadians lost $380 million overall in 2021, a scarier statistic when considering the fact that this was during the COVID-19 pandemic when many were experiencing financial instability.

Older adults both experience fraud at higher rates and face heightened difficulty in recovering financially. Data demonstrates that only 20 per cent of older adults report fraud to the police, which can influence whether victims receive justice. Further, only 34.6 per cent of adults 55 and over are employed, leaving the majority hindered in making their money back.

Why do older adults experience fraud more often and with greater consequences than any other age group? There is a lack of education given to older adults on fraud and how to prevent it. Especially during the COVID-19 pandemic, where our dependency on social media and email has increased, there must be a heightened awareness of the most prominent scams and how they can be avoided.

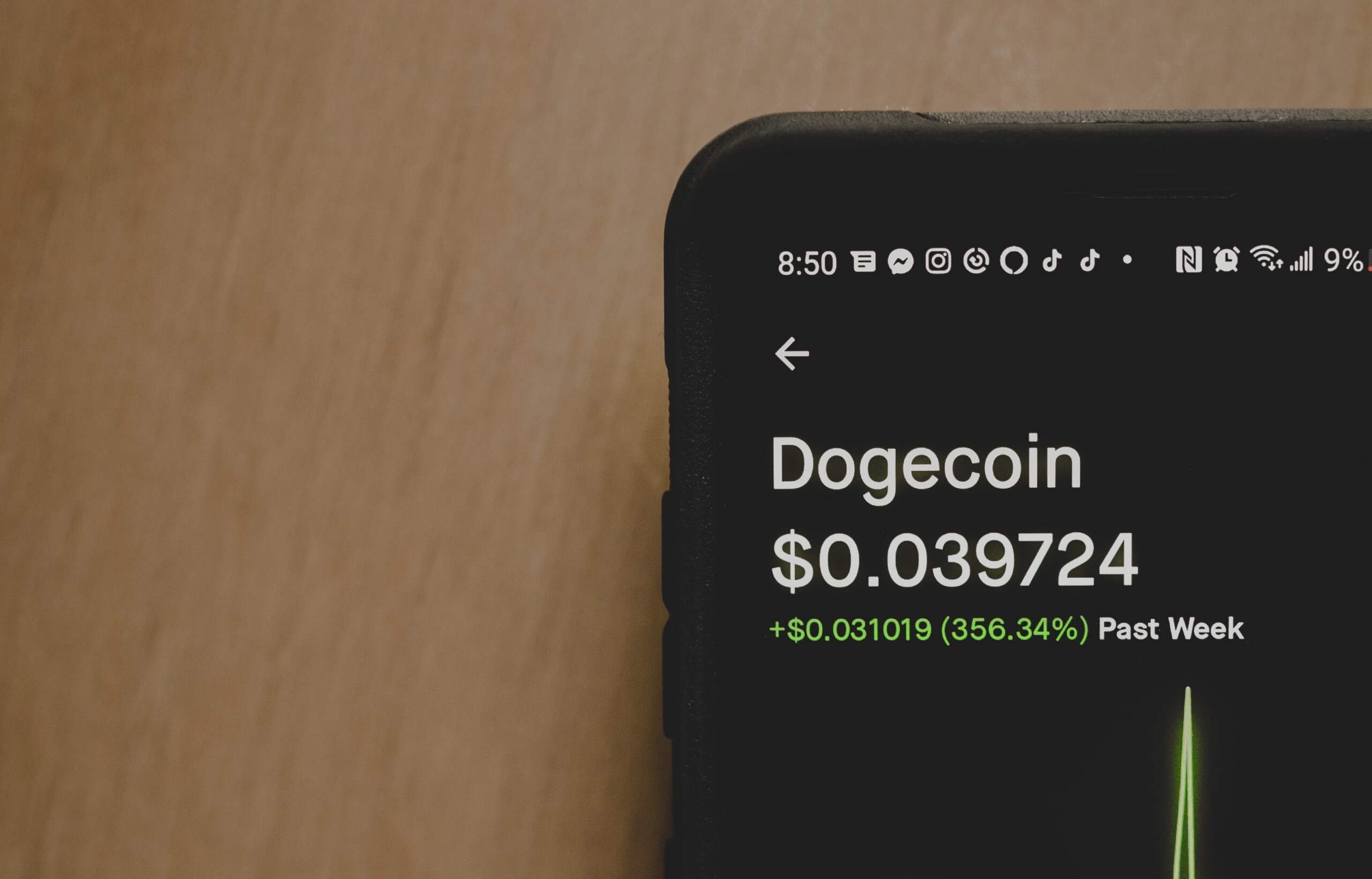

Although there are many different types of scams, the most common are romance fraud, grandparent fraud, and internet scams. Other forms to beware of are service scams, money transfer requests, charity scams, prize scams, investment scams, medical scams, and identity crimes.

Romance fraud becomes more frequent as dating apps become more popular. The scammer will use social media or an online dating service to gain the trust of the victim under the guise of a romantic relationship. The scammer will then communicate that they are experiencing a personal or family emergency, usually medical.

The emergency will require a large sum of money, one that the scammer doesn’t have. Alternatively, the scammer will have established that they live in a foreign country but would like to visit the victim. They will explain that they can’t afford travel, and ask you to cover their costs. Beware of anyone who claims they are located in a foreign country or displaying excessive affection early on.

Try not to give any personal or financial information to those you meet online. The key to avoiding romance scams is caution.

Grandparent fraud is particularly sinister due to its emotional and isolating nature. The scammer will contact the victim claiming they are in a medical, legal, or travel emergency. Should the victim ask to verify the legitimacy of the call, the scammer will give them the number of a supposed authority figure. This will instead be another scammer pretending to be legitimate.

Grandparent fraud is effective as the scammer will often insist that the victim not tell other friends or family members as not to get in even bigger trouble. The scammer will then obtain personal information or money. Legitimate legal authorities won’t ask for money through money wire services.

Always verify with other friends or family members the location of the supposed caller before volunteering any personal or financial information. Again, beware of suspicious requests, especially involving the sharing of information.

Extortion scams involve the use of coercion to obtain what the scammers desire. Scammers will contact the victim either by phone or email pretending to be a government official. Personal information is obtained by convincing the victims they are facing a government issue requiring anything from a password to a social security number.

Scammers receive money by convincing the victim that they are either owed a tax refund or owe money in outstanding taxes.

Extortion scams often involve threats of fines, deportation or arrest if their request isn’t satisfied after a certain deadline, prompting the victim to send the money without having time to think twice.

Legitimate government officials don’t use threats or money wire services. Before sending money or giving information always contact the organization itself first to verify. Don’t give personal information that the organization would already likely have on file.

The reality of fraud can be extremely overwhelming and anxiety-inducing; however, with the right knowledge fraud can be avoided with ease. The two phrases to remember most are “buyer beware” and “you don’t get something for doing nothing.” Beware of any contacts promising money or services with no strings attached.

If you’re not the one that made the call or sent the email, you never know who you’re talking to. Always remember to verify requests and consult with others before taking action. When an email has a link or attachment, do not click it — it can lead to the download of harmful viruses that can be used to extract information.

Above all else, remember to be cautious and aware of every interaction you’re having with someone online or over the phone.